todayOctober 6, 2021

All Posts Commodities People

All PostsCommodity Trading Week Americas 2024CTWA24Supply ChainSustainability

todayJuly 3, 2024

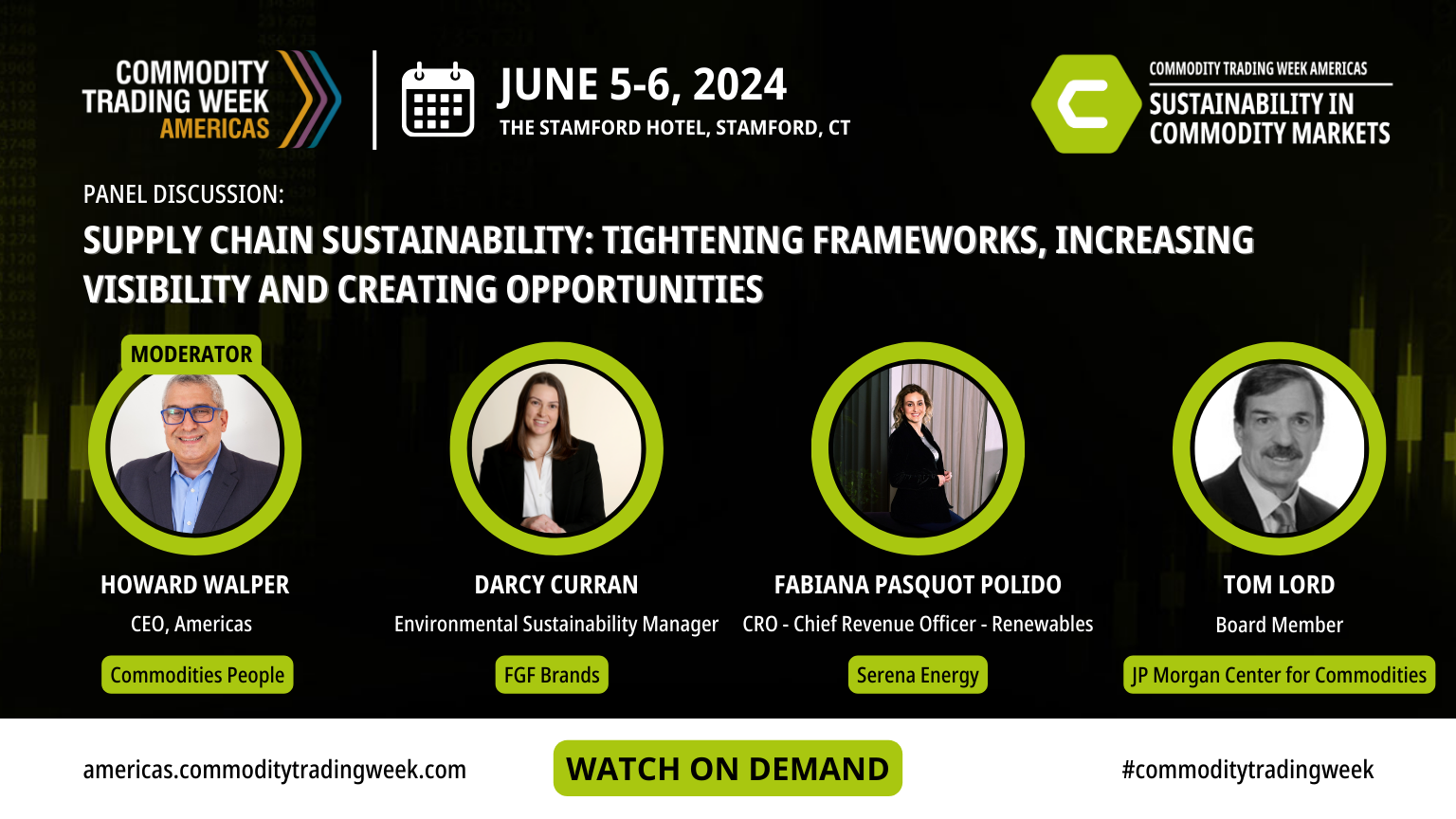

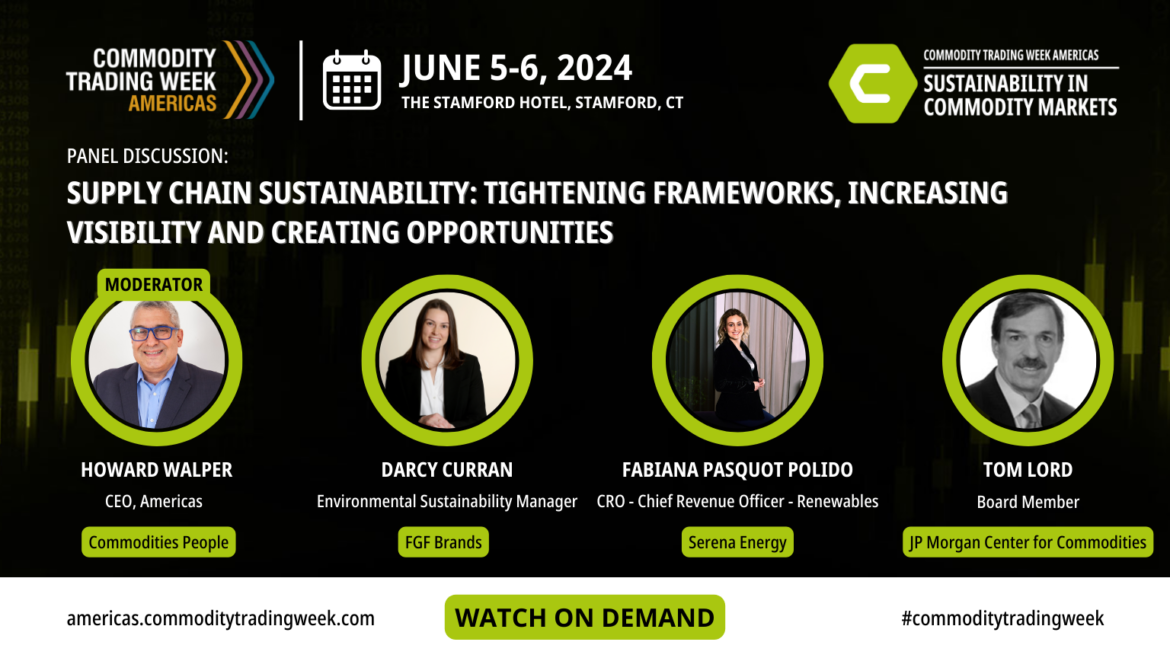

Darcy Curran, Director, FGF Brands

Fabiana Pasquot Polido, Serena Energy

Thomas Lord, Linklaters

Howard Walper, Commodities People

SPEAKER A

Hi, everybody. My name is Darcy. I'm an environmental sustainability manager with FGF Brands. We're one of the largest bakeries in North America. We have our own brands like Stone Fire, Non Simple Joys, Ace Bakery, Wonder Bread, and then we do a lot of private label as well, a lot of baked goods. Myself and the team work on projects relating to packaging, sustainability, waste reduction, utility use optimization, and education. I've been in the CPG industry for about five years now, and prior to that I worked as a biologist for the Nature Conservancy of Canada, Natawissauga Valley Conservation Authority, doing very traditional fieldwork and.

SPEAKER B

On the end here. Thank you very much. I looked over your line of products and it just made me really hungry.

SPEAKER A

It's a tough place if you're on a diet.

SPEAKER B

I will say, yeah. The low carb diet in particular. Yes. And it's weird being a moderator for a panel you're on. So, Tom, why don't you introduce yourself?

SPEAKER C

Tom Lord, been in the industry a while. 1st 20 years as a trader, mostly in NAC gas, almost all commodity space, energy, zags and metals. Did a lot of consulting work, actually sort of in this space. Now I do two things. I wear two hats. One, I work for a yemenite global law firm called Linklaters, running the north american risk process, where we offer risk solutions inside the legal practice. But also then I actually serve as a board member on an emerging 501 for the natural gas space, working on developing business standards for trading carbon intensity as a component rather than as an offset structure for natural gas, renewable and certified gas. And talk about in setting as opposed to all setting. Very cool.

SPEAKER B

And we were teasing him about it a little last night. But in all seriousness, I think you know at least a little about everything. So if I have a question about almost anything, you typically have some experience with it, and if not, I make up an answer. Exactly. Well, as the person managing a supply chain, let's start with you, Darcy. What are the most important components of creating a responsible sourcing framework across a supply chain? So let's set the sort of context to this.

SPEAKER A

Yeah, I think that's a great question. It definitely involves, I think the first aspect of it is collaboration. You know, when you consider a supply chain framework specifically in sustainability, you're talking about a lot of different players that you need to work with. Right. So it's really kind of grounding yourself in providing education for all of the parties involved, rooting the decisions that you're making in scientifically reputable frameworks that are based in, say, a science based target that have years of data in them, and then bringing into question as well what legal requirements are required in the areas, in the countries. A lot of us work not in just one country specifically. We might work across North America, South America, making sure that legally you're covering all of your bases, and I would say those to set up. Fundamentally, those are the aspects that you really need to be focused on.

SPEAKER B

Wonderful. So I'm going to throw this to the whole panel, but maybe start with you kind of picking up on something you just said, which is the importance of collaboration in sustainability. So maybe talk a little bit what that means to you and then the others can weigh in a bit.

SPEAKER A

Collaboration means, I would say, like everything. To me, collaboration is truly one of the most important parts of sustainability. I often say. And for those of you who were at the panel last night, sustainability is my job, but it's everyone's responsibility. I find it very hard to find a role in an organization like FGF where sustainability is not a part of your job. You know, whether you're in sourcing and part of your job is to source responsibly grown commodities, ingredients, whether you're in transportation, you're optimizing our routes that we're using less diesel and gasoline, whether you're in building support, making sure that our machines are running most efficiently. And so collaboration really is the foundation in which sustainability is built upon. And it's a, you know, obviously I work specifically in sustainability, and so a really important part of my job is making sure that everybody knows what their role is for sustainability. You know, I might have a team of five across North America, but I want a team of 4000, because every single person in the company is working on sustainability in their individual role.

SPEAKER B

Gotcha. How about you, Fabi?

SPEAKER D

Yeah, I was thinking here, like, when I started doing all the power trading business, etcetera, and then I decided to go for work working for a renewable company. When you talk about collaboration and then it's in our DNA. So, although we're making part of focus on solar and wind farms and so on, but it's also the individual behavior that also matters when you really know what sustainability means. And the most important thing right now is when you combine sustainability, like with environmental and all these fronts with reduction of costs, because only sustainability, only being green and looking for that, this is not going to work. So you have to have a combination of economy together. So in terms of looking from what I do today, it's cheaper to acquire a long term deal, PPA, when it's from wind or power resources. So along all the way, how much all the companies, like your company, or multinational companies that are also across borders, how much is important for them to buy electricity that comes from solar renewable sources. So it's a matter of collaboration? Yes, because it's not only what your company does, but all the supply chain, all the companies that are across the borders, inside the country that you are, that will make this energy transition happen. So I'm very excited because I like what they do, also because I work in a company that, you know, fill out all my purpose, all my values, and I like to be there because of that.

SPEAKER B

That's excellent. And Tom, you work across multiple clients and you advise them. What do you see in terms of how they're working with the market?

SPEAKER C

I'm going to be sort of the buzzkill, because I see collaboration as important. But the two things that I see in that context of collaboration is the framework. One is the framework of data, the sustainability. How do I track through, how do I get. I go back to the ugly scope one, scope two, scope three, how do I get the data? How do I make sure that it's good? And the second part is, legally, if I've got suppliers, how do I have the right in my contracts to get the data that I need? How do I make sure it flows through? That, to me, is the biggest challenge. We do a lot of ESG controls testing. I love it because being in a law firm I used to be big for, I can actually do my controls testing for somebody's ESG program underprivileged, so that if you do have a greenwashing case, they can't get my reports. And I've had cases where we go in, if somebody has a program and we test it, and anywhere from 30% to 50% of the processes are designed ineffective or the data is not right, and it helps people. I think that's, to me, the collaboration is making sure not only you've got it, but what you've got really works, as opposed to just, you think it.

SPEAKER B

Works and not to. By the way, is Tom's microphone working? I just want to make sure. I thought so, yes. Okay, good. Not to derail us off our questions on the second question, but chatting with someone the other day, and this may not be as be relevant to this situation, but he was saying, we were talking about some of the challenges of AI, and he had said, you know, the problem with AI is if I put, if I'm under a non compete or not, compete NDA, NDA, and I enter this data into the AI. I've already violated my NDA. And you know the idea as soon as you start sort of sharing data that it's not necessarily proprietary anymore.

SPEAKER C

Yeah. So we were actually, we were just having a conversation. I was having a conversation with a couple of vendors. I think the bigger problem on AI is not what you think you're entering, but if you have a vendor software, the vendor software really is important to know whether they've got AI in it, because that vendor software will strip your data out, put it in their software and take it out. That's where we're seeing quite bluntly. I actually sit on the committee chief risk officers, and we're doing right now a framework for model review and systems review. And part of it is the cyber drive down on what is in AI in your third party software. So I can tell you the energy world right now is looking that hard.

SPEAKER B

And I will say just if anyone is interested, the committee of chief risk officers is an excellent organization. I'm involved with them as well. Fabi, from the perspective of power, what's sort of the importance of getting everybody aligned in your supply chain or in your organization? What, do you have some thoughts on that?

SPEAKER D

Yeah, well, I think it's nice to bring some numbers here just to have an idea about the renewables PPA. Texas, for instance, last year they negotiated around seven gigawatts of renewable ppas. The whole United States negotiated 15 gigawatts. So why is this happening? Because most of the companies, they are really into this sustainability process. And when you go to the AI market, for instance, what's the AI is going to change? It's going to change the world. Everybody's talking about that today. But it's a very energy intensive user. So just to give an idea, some companies in the United States data centers company that will need to process a lot of data. They are talking huge, a massive amount of gigawatts for doing this path up to, let's say 2030. Some of these companies, they are speaking about 35 gigawatts. So in terms of how we need to have everything aligned, why is that? It's because if in the United States, and I'm speaking on the aircraft market, for instance, from Texas region, if the institutions, you know, the companies, the co ops are not into this world together, this is not going to happen. And what is going to, what the Texas is going to face or the US is going to face some of those companies because they are not able to get the energy they need, they will look abroad. So that's why now what sometimes we face sometimes just to get an idea of tariff, it takes three months to get from a co op the amount of how much it's going to cost, the tariff in that region that the client needs to have a clue about how much it's going to cost, the total cost of electricity. And just this year, just in Texas, we have already negotiated 1.8 gigawatts of renewable PPA. And in Brazil, like some companies that we have, it's a broad multinational company. Sometimes they have discussions with us, in us, but they say, okay, but in Brazil, how much this energy is going to cost. And some of those companies also are also looking for other countries like Chile and Paraguay, because since AI will need that demand, also like green hydrogen, it's another front that is, is changing how the world needs in terms of power demand. So, yes, if we don't have all the institutions like Aircott in place, all the companies together, and also legislation that will make the path easier, not bureaucratic. So then I think United States can be the front of this energy transition across the world.

SPEAKER A

Yeah. And I think just putting some context, like practical context into what you were saying, how important it is. We have some facilities in Texas, and as I said, we're a bakery. And we, like right now, during say like the five to ten peak, hottest days of the year, we already have brownouts in Texas. And from a sustainability perspective, from an operations perspective, obviously it's terrible because even 10 seconds for our operations is quite a big deal if there's a stop in electricity, but from a sustainability perspective as well, that's a lot of lost product that then, some of which might be thrown in the landfill, some might need to go to bakery waste, but it's still, there's these cascading effects of these brownouts of the demand that's currently being put on the electricity grid because the infrastructure in place can't meet that demand. And not just in Texas. We see it across North America moving towards electrification. There's a huge demand on the grid that currently cannot be met by the traditional fossil fuels that are fueling large parts of the grid.

SPEAKER C

Interesting question, because I'm going to throw this in. What do you see? Especially, I deal with a number of the ag universities, what's happening to your feedstocks with precipitation change, temp changes, that sort of stuff? Are you starting to see impacts on the grain markets?

SPEAKER A

If I'm being honest, I'm not in that section.

SPEAKER C

What I'm saying is, I see sustainability.

SPEAKER A

It is, are you going to have.

SPEAKER C

To shift stuff from in the world all of a sudden? These sort of things happen.

SPEAKER A

I mean, I think fundamentally, you know, climate change is real. It's happening. We're part of climate change is not just hot summers and really cold winters, it's changing precipitation patterns. So fundamentally, we are seeing changes in these weather patterns across North America. And so, you know, when you, when you think of that, so, yes, like, they would be drastically impacted by these changing patterns. I think more so than that. It's also making it more difficult to anticipate what the yields are going to be, which makes it very difficult, I'm sure, for my friends in sourcing who are trying to hedge on different commodities and better understand what we can get from our, it's not just the market.

SPEAKER C

Across all these chains. We're starting to see impacts on places where we don't normally think.

SPEAKER A

Exactly.

SPEAKER B

So changing gears a little bit, you know, talking about sort of the regulatory environment, what do you see in the regulatory space that's helping you or hurting your efforts towards sustainability?

SPEAKER D

I was thinking about this question, Howard, because I don't know if it hurts or if it helps, but, for example, we don't have a really straightforward regulation regarding additionality. So what is additionality? Just, you know, to give an idea, some of the industries, they come to discuss ppas with us and they say, but Fabi, we cannot have operational assets. So the windmill cannot be operational. I need to buy, you know, a project. So then you go there and you build a project, and once the windmill is ready, so then I can acquire the electricity from that. So there are some companies that they say, well, two years operational asset for us is great. I can count as additionality. Additionality is like to neutralize the scope two from the GHG protocol because it regards the energy consumption. So we don't have a right rule. So we never know what the edge tonality can mean for a company. So for me, it's sometimes helps because we have a project that will be developed, that will be built, and then it's, you know, fit with the client. But sometimes we don't. We have operational assets that is already in place just to sell the electricity and we don't have the additionality for some of the counterparties. So from me, from these, I think it would be great to have a clear rule about what additionality means.

SPEAKER A

Yeah. And I think I have a good example of where we're finding legislation and regulation is really helping us. It's a very contemporary example. We're largely based in Canada. Up in. We're just north of the GTA. And in Ontario, just in the beginning of May, they introduced new legislation that allows class A customers, which are large users of electricity, to offset what we call our GA, or global adjustment costs. So this is the cost that we pay into for the percent of energy we use during the five peak hours of the year. And we're able to offset these costs through the investment of a VPPA. And I think that is so smart, because what this does is it's helping us cut our costs, a, win right away. B, it's also helping the investment in renewable energy production in Ontario, Canada, North America. We can work with various firms to source, you know, not just solar, but wind, hydro. Really kind of diversifying your portfolio. For those who heard the conversation yesterday, there was a really great chat from, I can't remember the gentleman's name about, you know, diversifying your portfolio for VPPA is not wanting to kind of put all your eggs in one bucket, but I think that is such a good example of how regulations can support the development of the renewable energy and also, you know, work together with sectors like the industrial sectors to help offset our own costs.

SPEAKER B

Excellent.

SPEAKER C

And Tom, regulations and sustainability. So I'll choose just a couple. One is, and we talked about it yesterday, is California's SB 253 and 261. For those who weren't in that room, California has passed. 261 is a law that says if you do business in California, somebody said yesterday, fifth largest GDP country in the world, and they still roughly define, but let's sort of put it as about a million dollars worth of revenue. Or you have an office, or you have people there, and your global revenue for any parent or affiliates is more than $500 million. You'll be, starting at the end of your 2025 fiscal year, required to file a TCFE, which is a global climate risk analysis for all of your assets globally. And this is not just public, this is public and private firms. SB 253 is the same thing. But if you've got a billion dollars worth of revenue globally, you have to file a greenhouse gas protocol. Scope one and scope. Scope two. Emissions report with the state of California at the end of 2025. And starting in 27, you have to file a scope three, and that is for all firms. So if you want to do business in California, which everybody wants to, you're going to. And it does not matter whether you're public or private. It's the only law globally that covers privates. The other places, then Howard knows this. I'm actually part of the board of a brand new trade association working in what is now called in the industry rocked dock, which is from the wellhead to the LNG flange by for building in North America. And I think this is where sustainability may be going when we talk about supply chain is, rather than creating offsets for methane is what's called insetting, which is you do nothing, sever the attribute for VPPN, it stays with the product. And so that you are selling the reduced carbon intensity of the product. And this is going to become very important in probably the next three to five years for even being able to sell LNG into Europe, because they've got what's called a cross border adjustment mechanism. And the cross border adjustment mechanism requires you right now for seven products, steel, cement, fertilizer, plastics, a couple other things. You must state the life cycle carbon intensity of that product. And if it doesn't meet their benchmark, you pay a basically tariff of about $30 to $40 a ton for the carbon intensity over their benchmark. This will be applied, they started for seven. I believe they're adding five more products per year every year. So where you will be coming, I think you will see in the next three to five years, supply chain will no longer be offsets. It will be, can I buy reduced carbon intensity of my supply chain products, whether it's wheat, nat gas, you know, we're not buying a BPPA, but actually buying the renewable power in your grid as opposed to going to Texas and buying the offsets. This is where I think supposedly supply chains go in the next five years and offsets will be reserved for reductions, won't be an additional test. It will be, am I planting trees? Am I doing deforestation? So I think that landscape for sustainability in the next five years and supply chains may fundamentally change.

SPEAKER B

Well, I could open this whole, this one line of questioning up to a number of different questions, but we'll be on here. No, I was just speaking to somebody about this. I feel like my microphone is so much louder than everybody else at the moment. Does it come off that way? I keep speaking softer and softer and booming out. I was just talking to someone about RNG and the challenges of just getting it from source to the processing plants and how much you lose along the way, how much you lose in the process of processing it and then not being able to apply sort of a standard formula to that makes a big difference when you're trying to actually load it onto a ship and say, hey, we have this much and we produced this much. Anyway, let's go back to Darcy on this. Get back to sustainability initiatives at your company. How do you prioritize your initiatives aside from carbon mitigation? And what are some of the big projects you're working on? I know one of the things we touched on were plastics and plastic credits, but what are some of your big initiatives?

SPEAKER A

Yeah, so packaging is a really big one for us. We are a part of the or signatory to the Canada Plastics pact, so we're committed to having 100% of our own brand packaging, reusable, recyclable or compostable. But for us, that's not as much of an area of focus because it's not as applicable to our materials. The goal was by 2025, as well as having some recycled content in there. So we work very closely again with our sourcing teams and our marketing teams to make sure that we're creating a package that the consumer can also feel good about. So we've made a lot of strides in this area, you know, moving from, say, multi material, multi laminate bags to monomaterial recyclable PE or PP bags. This is an area that, if you don't know a lot about recycling, there is so much going on in this space, it's truly incredible. You know, in Canada, we're seeing the rollout of what's called EPR, extended producer responsibility. Whereas before, say, FGF would have split the cost with the municipality for their recycling program, now producers like us are responsible for the entirety of the program. So, a, our costs have gone up, obviously, 100, 150%. Our finance team's not thrilled about that one. But why I like I'm in support of this is because what this does is it really encourages the producers to be making packaging more recyclable, because you pay more for non recyclable items like styrofoam, which is EPS or expanded polystyrene. We're paying more for that if we don't have it in our materials. But if you did, you're paying a lot more than, say, if you just had a PE bag. So it really, I think, does a really good job of financially encouraging producers in this area, and it gives us a little bit more control as well. And the idea is, in the next couple years, we'll be able to get that recycled content back. So if I say I put x amount of metric tons into the blue box program in Ontario, I get that back as recycled content to then reintroduce into my own systems.

SPEAKER C

Do you see other states on the California going there.

SPEAKER A

Yep, we're seeing more and more. Yeah. So this is across Canada, but we're seeing the introduction and the idea of EPR rollout across the US. You know, New Jersey has legislation that came into place earlier this year for mandating recycled content. Food grade is a little bit behind, for obvious reasons. A little bit harder to source. You know, it has to come directly from food contact sources, which does just make it a little bit more difficult. But 100%, you know, we're seeing this rollout across North America and, you know, for those of you who've traveled to Canada, there is quite a big difference, no offense to you guys, in the US, between the recycling programs, you know, what we have up there and here, from a curbside municipal collection perspective, there tends to be a lot more, you know, a lot more programs available to a lot more, you know, individuals in Canada than here. So I'm really excited to see the movement. But these are projects, you know, this is something that we're working on right now.

SPEAKER B

I'm fairly sure the difference between where I live, between the regular garbage pickup and the recycled pickup is the color of the truck. So this is a question for everybody. We're going back to the. The idea of collaboration. We can pick up on some of these data issues. Collaboration requires a degree of transparency. How do you track and verify inputs from your various suppliers across the supply chain? What kind of technologies do you use? And is this a good role for, say, a blockchain system? Still the technology out in search for a lot of applications, but sustainability seems to be a good one because, you know, you're having a lot of different parties all entering into a single source of truth.

SPEAKER A

Yeah, truth.

SPEAKER C

I've had three of the last five cops. I've had any number of conversations on blockchain. The problem with blockchain in sustainability is blockchain is normally built referential to the company. And the problem is my scope three becomes someone else's scope three. And my scope one becomes someone else's scope three. I will give you the example that the SEC rules create that creates a complete nightmare for every lawyer I deal with. We now talk about the SEC. You're going to have financial reports. Let's say I've done my financial reports for the last five years, and it turns out that my scope three includes Volkswagen. And Volkswagen just now says, oh, by the way, all of my. All my data is incorrect. It means I have to go back and revise all of my ESG for the last five years. All of my buyers have to go there. And literally, if you did it for someone like Boeing, it comes back on its own tail as an infinite loop, because Boeing sells the, someone who now has an airplane, who now has done engines that have been flung back to Boeing, and literally, it's an infant loop.

SPEAKER B

The problem with you. Hope so.

SPEAKER C

The problem is with blockchain is you all of a sudden create the question of where in my blockchain is that data for whom? And so unless you have an outside entity that creates a blockchain for the world, it's going to be very difficult.

SPEAKER A

No, no, I'm very much in agreeance with you. It's tough because when you talk about, you know, there is a degree of transparency. So for us, you know, we manage and we actively track scope one, two and some three emissions in a third party software. And we use this software as well to send out surveys to say, our top 50 suppliers and say, okay, you know, what of your emissions can you attribute to us? And the problem is, when we get that data, we can't really validate it. We just have to take that they're right. And that's. I 100% agree with you. And, you know, we can all say, oh, we're all using the GHG protocol, we all use the same method, but you might just not be doing it right. You might just be missing sources. You know, you might. There's human error involved in there. You might miss a decimal somewhere. That really cascades and means that either maybe you're showing we have more or less. And what I love about, you know, carbon emissions is fundamentally, if we all just took care of our own scope, one and two emissions, there are no scope three emissions. But I think that's just nothing real life right now. But it's kind of an interesting idea to play with as we were all just responsible for what we do. That eliminates that completely. So it's a really, really hard area for us to be in right now. We just have to, right now just say, okay, well, I hope I think you're right. And I know you're putting work into this, but, you know, and not everybody is sustainability. Sure, it's a huge area, but I think you'd be very surprised at the amount of people that we work with who are just not doing it, not tracking their emissions and are not involved.

SPEAKER B

In fact, I'll get to you in 1 second. I want to go back to that. Just attitudes, right? General attitudes. Canadian with operations in Texas. Yeah, operations in Texas. You must have to deal with sort of a cultural, you know, just cultural differences in attitudes towards sustainability.

SPEAKER A

Yeah, a little bit. And truthfully, that's one of my favorite parts of my job. I love building communities, and I think, you know, having the opportunity to be in front of people and really, again, it brings back to collaboration. Like, why is it important? I mean, it's definitely 100% what you're saying is correct, but I think there's such a great opportunity to then educate and inform. And when you take these very contemporary examples of, hey, you guys had a brownout the other day, it cost x amount of dollars, and then your sanitation team had to spend 10 hours cleaning up and doing all this extra work. Like, people can see the real life examples of why it's important. But, yeah, definitely challenging, you know, and across the different states, different regulations and all that does make it a little bit challenging. But I would say it's all part of the fun. And, you know, I have a great team behind me who really kind of rises to the challenge and really, really takes that on kind of head on.

SPEAKER B

Fabi.

SPEAKER D

Well, at Sirena, we have implemented, we have an in house system for tracking all the sustainability front. So we do some auditing in our supply chain and also inventory regarding the scope, one, two and three. For example, sometimes we get some training as we get some surveys about, like, how many, how many, so how you come into work, how many flights you took this year. So in order to also adjust how much is going to be in the inventory. And we also report, we have ESG report environmental, social and governance. And another thing that is also very important for other companies, especially, for example, speaking on Brazil side, is because most of the multinational companies, they want in this governance, in the ESG regarding corruption. So we have to go through these policies with every company, every counterparty that wants to do business with us. And nowadays, since the past two years, we were only in Brazil, but now we are in Brazil and in the United States. So the geopolitical issues, they matter now. So it depends on whom you are trying to, you know, import the equipments, like, such as, let's say, you know, solar panels you cannot import from China. And if you want to go and do some business with Russia, we have so many european investors. So when we put all this together, how do you map that? So we did that internally, but with the blockchain, I think it is still a challenge for us. If it shows to be a good path, we might consider. But I think it's really hard because things change so quickly every day.

SPEAKER A

The professional answer from all of us is it's really hard.

SPEAKER B

Why don't you talk a little bit about the role of ppas in supply chain decarbonization?

SPEAKER D

Well, I think it's. What is happening right now is what is. I work now in structured deals. I used to do, you know, retail power trading, but now really much more structured deals. Usually in the past you have, you know, it's very common to face virtual ppas, more like more financial negotiation and also a normal standard PPA. But what is happening also is that some companies, they are looking at the behind the meter solution, which is nice to speak about that because it's a combination. That facility is going to be built inside in the same place where the wind and solar plant is. So right now the modelings are showing that we can have 75 capacity factor to attend the need of this is happening already in Texas. Like some companies, they are really looking to the behind the meter solution because they are going to pay a better price and they won't depend on the grid. So just a small portion, a small portion of that that is going to be consumed from the grid and battery. Once battery is cheaper, because it still is very expensive, then you have the whole equation of 100% capacity factor 24/7 so from the power purchase agreements they are becoming much more like structured deals to really attend the needs from each company. And the companies, they are really much into that. They don't buy just electricity, they want bundled ppas, they want electricity plus the certificate, the renewable energy certificate, the Rex and believe it or not, the Rex. Now for the long term, for those projects that will be built, it's over $4 per certificate. It's a very incredible price.

SPEAKER A

And there per megawatt hour.

SPEAKER D

Per megawatt hour, yes it's 1, it's megawatt hour is one certificate. So most of the companies special, of course these data center companies and also the green hydrogen companies and packaging industry also is very fan of bundled ppas. They are really into that.

SPEAKER C

It does three things for you. One is in a lot of these regional transmission operators, ISO RTo's the backlog to get an air connection to the grid can be three, five, seven years if you're doing behind the plant.

SPEAKER D

Yes, exactly. You don't queue speeding it up too.

SPEAKER C

As we talked about, you no longer buying offsets. So in certain of these standards associated out there, you no longer have. You're meeting some of the science based targets where they're talking about reducing your footprint as opposed to buying offsets. But the third one is by buying that power that way and nothing. Buying a wreck you get out of the greenwashing world.

SPEAKER D

Yes.

SPEAKER C

Because you no longer have the shareholder risk associated with it. So bluntly, it's a better risk management tool for the corporation, including financing. So you're getting multiple benefits in that structure.

SPEAKER D

Yeah. And just to have an idea, additional demand, like extra demand. Around 40 gigawatts was added to get the transmission line connected in the grid of aircraft. It's a massive amount. Just this year, it's an extra 40 gigawatt in the system. And like, if we don't get that in place, we cannot get the windmills or solar farms connected to the grid. So that's why it's an easier solution to solve this matter in a quicker way.

SPEAKER B

We are coming towards the end of our time, so I'm going to consolidate the next couple of questions because it's. I think we got. I like talking.

SPEAKER D

That'S why we have.

SPEAKER B

That's why we're all here. They gave me a microphone, I'm going to use it.

SPEAKER D

And I love this microphone because I like to speak with my hand.

SPEAKER B

Right. Right. So you all. We were talking about sort of. You've all talked about working across different regions. You all work. What are some of the challenges with developing sort of a framework for working across different regions? And I think this sort of relates to what you were talking about the other day, Tom, with the three blind men describing an elephant.

SPEAKER C

I think the simplest one is much of the rest of the world is in what's called a compliance market. So you have offsets that work in a structured manner in different risk mechanism. The US stays outside that. Plus just how companies, how countries work there, the concept of additional other things become very difficult. The Delta lawsuit. Delta was sued for greenwashing is a great example of that, where one of the claims was Deltas offsets, they bought, the vast majority of them were under what's called an ECM, under the UN, from the government of India. And they were claiming that the government in India managed their wind investment program for determining whether you qualify for an offset improperly. So you were asking the us court to invalidate actions of the government is just a huge jurisdictional issue. Where do I buy things and can I buy offsets? That's just one very simple example of how difficult it is when you have different jurisdictions implementing their own programs and then the court stepping in and saying, well, we're going to go look at whether they're doing it.

SPEAKER D

Right.

SPEAKER A

Yeah. Yeah. So, no, that's a great example. And I think, too, when we look at it at a bit more granular level, you know, we have facilities across Canada and the US. So, you know, Canada, we might be a little bit more, you know, at a federal level, regulations might be a bit more similar. I find in the US it's a little bit more fractured in terms of state specific legislation. And that can be really challenging. And, you know, to kind of mitigate this, you know, we have to spend a lot of time reading, unfortunately, kind of boring legislation to make sure that we're, you know, everyone here who's read legislation knows it's not, it's not a fun read, but, you know, making sure that we're doing our due diligence and in the areas where we're not seeing, you know, say, robust sustainability legislation, say, for example, in Texas, it's, you know, taking personal responsibility and applying what we do in other areas to be environmentally responsible to these, to these sites. So, you know, in Ontario, we're regulated to do waste audits every year. So do we have to do this across our us facilities? No. Do we do them anyways to see what other opportunities we have to recycle, you know, different materials? Yes. So I think it's also just taking some personal responsibility for the areas that you have control over. Definitely, yeah.

SPEAKER D

When I think about all the countries we have been working with in the power sector, I believe, for example, in Brazil, carbon credits market is not regulated. It's voluntary. So it makes a little bit hard because you don't have, you know, it's not transparent how much the carbon credits being traded and how much, you know, what are the source. So it's very OTC and very voluntary. So there is not a standard or a rule that regulated that. Another thing that I cross borders, especially with the demand coming from green hydrogen, is how you calculate the emissions. Some of the countries, they go for annual calculation of emissions. Others, they speak about our hourly emissions. So it's not, it's not a clean view about how can you face and how can you cope with a more, I mean, more international rule than, you know, applying for different countries, different rules. So, and additionality, of course, that I mentioned before, I think the a huge issue coming over. And that's it.

SPEAKER B

Well, you know, you're all talking about how to measure emissions. If only we had an expert from an oil company who would tell us how to account for carbon, that would be one. Wait a minute, we do have one coming up next. That's called setting it up. So we're going to, let's end with this one, sort of a quick answer on this. But we spent a lot of time talking about the costs and the challenges of implementing programs, sustainability programs, maybe talk about how can you use this to be a competitive advantage in the marketplace. So I'll let any of you start if you'd like.

SPEAKER D

Well, the good news is, like most for us, it's part of our DNA. We are a renewable company. But it's important that it's everybody that goes to search for you, because I deal with the commodity. It's energy. It's energy everywhere. Electricity everywhere. So sometimes we really like to get into the details and go into the pain of every client, what they need, what they really are looking for, because, of course, it's, we'll give an idea. Sometimes we like to partner with. Let's say we create some solutions. This is happening in Brazil. So we have some generated distribution, some solar farms in some special states in Brazil. So then what we did was offering the, the coworkers from that company a discount in electricity in that state. So you create some solutions through sustainability, because that's important for them. And they are also giving the coworkers, the coworkers discounting the electricity bill. So this is a way that you find ways to show the importance. But this is true. This AI cannot do. This is like me speaking with the clients, and let's talk about the pain, what's painful for you guys? So it's always related to how much solution can you create, how creative you can be to provide more sustainability through what you offer as a product.

SPEAKER B

Excellent.

SPEAKER A

Yeah. And I think from a food manufacturing perspective, when we talk about competitive advantage, you know, I really look at it from what the consumer experience can be, and, you know, what, as FGF, what can we provide that's more of sustainable than our direct competitor? And when I say consumer, I don't just mean you and I to our larger customers. They're asking a lot of us for sustainability. So to be able to rise up and meet those goals quicker, more efficiently, be able to speak to the projects that we're doing more eloquently, being ahead of the curve really does provide us a competitive advantage and makes us a more attractive organization to work with.

SPEAKER B

Wonderful. Did you have anything you wanted to talk about?

SPEAKER C

The trade association? I think for the commodity space is offsets are a very difficult structure for many companies because you have to accept a whole trading group that's different. It becomes very different. I think for the commodity space, the ability to differentiate and compensate people for being green so that there is a structure for pricing. If I've got a lower carbon intensity plastic, how do we pay for that? Because what we see on the supply side is if I get greener, how am I going to get paid? For me, the biggest thing is going to be creating markets where here's brown, here's green, and we trade it just like a quality differential we do in crude or something else. If we get to that, we can use the most liquid, transparent and efficient markets that we have in nat gas, WTI and everything else. If we can start making carbon equality rather than a completely separate entity, we will drive this in a way nobody thinks of.

SPEAKER B

It's going to have to be the last word. And I encourage you guys, if you have any.

SPEAKER A

Great last word.

SPEAKER B

Yeah, that is the final word. Had something of gavel to bang or something. Let's have a round of applause for this really excellent panel. Thank you very much. Thank you very much.

Written by: Commodities People

Commodity Trading Week Americas CTWA CTWA24 Opportunities Supply Chain Sustainability Visibility

labelAll Posts todayJuly 3, 2024

CTRM Evolution: Adapting to new business dynamics, AI integration, future-proofing. Adaptation, AI integration, and future-proofing strategies.

labelAll Posts todayFebruary 17, 2026

labelAll Posts todayFebruary 16, 2026

Copyright 2024 Commodities People

ABOUT MOLECULE

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

Lead CTRM/ETRM Partner

Molecule is the modern and reliable ETRM/CTRM. Built in the cloud with an intuitive, easy-to-use experience at its core, Molecule is the alternative to the complex systems of the past. With near real-time reporting, 30-plus integrations, and headache-free implementations, Molecule gets your ETRM/CTRM out of your way – because you have more valuable things to do with your time.

ABOUT cQuant

Founded in 2015, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

cQuant.io is a team of senior quantitative model developers, experienced energy analysts, software developers and cloud infrastructure experts. Leveraging decades of energy experience, cQuant.io is committed to serving the present and future analytic landscape with the most accurate models and highest performance in the industry. The field of analytics is changing rapidly and cQuant.io is dedicated to offering the latest advantages to their customers.

LEAD ANALYTICS PARTNER

Founded in 2015, cQuant.io is an industry leader in analytic solutions for energy and commodity companies. Specializing in Total Portfolio Analysis, cQuant’s cloud-native SaaS platform simulates all risk factors, optimizes portfolio decisions, and includes dynamic reports and dashboards for better decision making. cQuant’s customers have greater insight into their financial forecasts and the drivers of value and risk in their business.

ABOUT Digiterre

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

PARTNER

Digiterre is a software and data engineering consultancy that enables technological and organisational transformation for many of the world’s leading organisations. We envisage, design and deliver software and data engineering solutions that users want, need and love to use.

ABOUT GEN10

Gen10 focus on making the day-to-day tasks of commodity and carbon trading faster and simpler through automation and collaboration. Our technology empowers our clients, completing the feedback loop between trading and finance to support smarter, safer trading decisions.

PARTNER

Gen10 focus on making the day-to-day tasks of commodity and carbon trading faster and simpler through automation and collaboration. Our technology empowers our clients, completing the feedback loop between trading and finance to support smarter, safer trading decisions.

ABOUT CAPSPIRE

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

PARTNER

capSpire is a global consulting and solutions company that creates, customizes, and implements value-driving technology for commodity-focused organizations. Fueled by direct industry experience in commodities trading, risk management and analytics, they offer expertise in business process advisory, managed services and operations consulting.

ABOUT QUOREKA

In the Commodity Trading and Management business, expertise emerges as the most valuable resource. A deep understanding of the commodity trade lifecycle is what makes Quoreka, the leading Commodity Trading, and Commodity Management solutions provider.RISK SUBJECT EXPERT

In the Commodity Trading and Management business, expertise emerges as the most valuable resource. A deep understanding of the commodity trade lifecycle is what makes Quoreka, the leading Commodity Trading, and Commodity Management solutions provider.

ABOUT RadarRadar

We are RadarRadar (formerly Tradesparent). Experts in the commodity trade and processing industry. Operating in the most fundamental industries of the world, food, energy and other commodities. Since 2010, we deliver high profile projects for the world’s leading commodity producers, traders, and processors. We work with our clients to configure bespoke and extendable data solutions, enabling their successful digital transformation.SPONSOR

We are RadarRadar (formerly Tradesparent). Experts in the commodity trade and processing industry. Operating in the most fundamental industries of the world, food, energy and other commodities. Since 2010, we deliver high profile projects for the world’s leading commodity producers, traders, and processors. We work with our clients to configure bespoke and extendable data solutions, enabling their successful digital transformation.

ABOUT SOS Mediterranee

SOS MEDITERRANEE is a European, maritime-humanitarian organisation for the rescue of life in the Mediterranean. It was founded by European citizens who chartered a rescue vessel in order to save people in distress in the Central Mediterranean – the in the world’s most deadly migration route. Our four headquarters are located in Berlin (Germany), Marseilles (France),

CHARITY PARTNER

SOS MEDITERRANEE is a European, maritime-humanitarian organisation for the rescue of life in the Mediterranean. It was founded by European citizens who chartered a rescue vessel in order to save people in distress in the Central Mediterranean – the in the world’s most deadly migration route. Our four headquarters are located in Berlin (Germany), Marseilles (France),

ABOUT WISTA Switzerland

ASSOCIATION PARTNER

WISTA Switzerland is a key global shipping and trading hub, with regional clusters in the Geneva Lake area, Zug/Zurich and Locarno. The shipping and trading activity in Switzerland provides over 35’000 jobs and represents 3.8% of the Swiss GDP. Switzerland, and Geneva in particular, is also home to international organisations such as the World Trade Organization (WTO) and the European Free Trade Association (EFTA) and the United Nations Conference on Trade and Development (UNCTAD).

WISTA Switzerland was founded in Geneva in 2009 and incorporated according to the WISTA International statute in January 2010. The Association is active in both Geneva and Zug/Zurich chapters with the Board and Members meeting monthly to discuss topics of interest, exchange ideas and experiences. We also meet for networking events, conferences and member exclusive coaching sessions.Every year, several conferences are organized by Wista Switzerland on latest developments in the industry in both areas Geneva and Zug/Zurich.

Founded in 1983, the Club has been actively involved in the local and international Shipping and Trading community and presently is proud to have about 160 members including individuals working as shipowners, traders, charterers, logistics providers, agents, banks, insurers and lawyers as well as a large number of companies active in the market.Geneva is a global hub for Shipping and Trading and in an industry where network is key to one’s individual and to the industry’s success, the Propeller Club serves a vital role.

The Propeller Club organises a range of events which are open to the Shipping and Trading community both in Geneva and those visiting for work or pleasure. These events include monthly evening events focused on specific topics combining learning and networking opportunities. On a more social level, the Club organises networking events such as our annual events to celebrate Escalade, an annual outing on the Neptune on Lake Geneva and a summer lunch. The Club also organises drinks events to promote networking in the larger community.

The Propeller Club is in close contact with Propeller Clubs in ports and cities throughout Europe and further afield to coordinate our activities and to create value for the broader network.

ASSOCIATION PARTNER

The Propeller Club – Port of Geneva is a professional association providing opportunities for Shipping and Trading professionals to network and develop their knowledge.

Founded in 1983, the Club has been actively involved in the local and international Shipping and Trading community and presently is proud to have about 160 members including individuals working as shipowners, traders, charterers, logistics providers, agents, banks, insurers and lawyers as well as a large number of companies active in the market.Geneva is a global hub for Shipping and Trading and in an industry where network is key to one’s individual and to the industry’s success, the Propeller Club serves a vital role.

The Propeller Club organises a range of events which are open to the Shipping and Trading community both in Geneva and those visiting for work or pleasure. These events include monthly evening events focused on specific topics combining learning and networking opportunities. On a more social level, the Club organises networking events such as our annual events to celebrate Escalade, an annual outing on the Neptune on Lake Geneva and a summer lunch. The Club also organises drinks events to promote networking in the larger community.

The Propeller Club is in close contact with Propeller Clubs in ports and cities throughout Europe and further afield to coordinate our activities and to create value for the broader network.

Gafta is the international trade association representing over 1900 member companies in 100 countries who trade in agricultural commodities, spices and general produce. Gafta is headquartered in London and has offices in Geneva, Kiev, Beijing and Singapore. More than 90% of Gafta’s membership is outside the UK. With origins dating back to 1878, Gafta provides a range of important services that facilitate the movement of bulk commodities and other produce around the world.

It is estimated that around 80% of all grain traded internationally is shipped on Gafta standard forms of contract and Gafta’s arbitration service, based on English law, is highly respected around the world. Gafta also runs training and education courses, manages Approved Registers for technical trade services and provides trade policy information, and events and networking opportunities for members.

Gafta promotes free trade in agricultural commodities and works with international governments to promote the reduction of tariffs and the removal of non-tariff barriers to trade, as well as a science and evidence-based approach to international trade policy and regulatory decision making.

ASSOCIATION PARTNER

Gafta is the international trade association representing over 1900 member companies in 100 countries who trade in agricultural commodities, spices and general produce. Gafta is headquartered in London and has offices in Geneva, Kiev, Beijing and Singapore. More than 90% of Gafta’s membership is outside the UK. With origins dating back to 1878, Gafta provides a range of important services that facilitate the movement of bulk commodities and other produce around the world.

It is estimated that around 80% of all grain traded internationally is shipped on Gafta standard forms of contract and Gafta’s arbitration service, based on English law, is highly respected around the world. Gafta also runs training and education courses, manages Approved Registers for technical trade services and provides trade policy information, and events and networking opportunities for members.

Gafta promotes free trade in agricultural commodities and works with international governments to promote the reduction of tariffs and the removal of non-tariff barriers to trade, as well as a science and evidence-based approach to international trade policy and regulatory decision making.

ASSOCIATION PARTNER

The International Trade and Forfaiting Association (ITFA) is the worldwide trade association for companies, financial institutions and intermediaries engaged in trade and the origination, structuring, risk mitigation and distribution of trade debt. ITFA also represents the wider trade finance syndication and secondary market for trade assets. ITFA prides itself in being the voice of the secondary market for trade finance, whilst also focusing on matters that are relevant to the whole trade finance spectrum.

ITFA presently has close to 300 members, located in over 50 different countries. These are classified under a variety of business sectors, with the most predominant being the banking industry. Others include forfaiting, insurance underwriters, law firms, fintechs as well as other institutions having a business interest in the areas of Trade Finance and Forfaiting.

To find out more about ITFA, please visit www.itfa.org or send an email on info@itfa.org

ASSOCIATION PARTNER

The ICC Digital Standards Initiative (DSI) aims to accelerate the development of a globally harmonised, digitalised trade environment, as a key enabler of dynamic, sustainable, inclusive growth. We engage the public sector to progress regulatory and institutional reform, and mobilise the private sector on standards harmonisation, adoption, and capacity building.

The DSI is a global initiative based in Singapore, backed by an international Governance Board comprising leaders from the International Chamber of Commerce, Enterprise Singapore, the Asian Development Bank, the World Trade Organization, and the World Customs Organization.

ASSOCIATION PARTNER

BIMCO, the practical voice of shipping, is the world’s largest international shipping association, with around 2,000 members in more than 130 countries, representing over 60% of the world’s tonnage. Our global membership includes shipowners, operators, managers, brokers, and agents. BIMCO is a non-profit organisation.

ASSOCIATION PARTNER

Founded in 1972, ANRA is the Italian Corporate Risk and Insurance Managers Association. The main goal of the Association is to promote the establishment and development of risk management knowledge in Italy and to strengthen its own reputation of privileged interlocutor as well as institutional representative for matters concerning risk management. ANRA intends to offer to its members professional update programmes and the opportunity of exchanging experiences.

ASSOCIATION PARTNER

The Society of Technical Analysts (STA) www.technicalanalysts.com is one the largest not-for-profit Technical Analysis Society in the world. The STA’s main objective is to promote greater use and understanding of Technical Analysis and its role within behavioural finance as the most vital investment tool available. Joining us gains access to meetings, webinars, educational training, research and an international, professional network. Whether you are looking to boost your career or just your capabilities – the STA will be by your side equipping you with the tools and confidence to make better-informed trading and investment decisions in any asset class anywhere in the world. For more details email info@technicalanalysts.com or visit www.technicalanalysts.com

ASSOCIATION PARTNER

CTRMCenter™ is your source for everything ‘CTRM’. This online portal, managed by leading CTRM analysts – Commodity Technology Advisory LLC (ComTech), features the latest news, opinions, information, and insights on commodity markets technologies delivered by some of the industry’s leading experts and thought leaders. The site is visited by more than 1500 unique visitors per week. CTRMCenter also includes free access to all of ComTech’s research in the form of reports, white papers, interviews, videos, podcasts, blogs, and newsletters.

ASSOCIATION PARTNER

Trade Finance Global (TFG) is the leading trade finance platform. We assist companies to access trade and receivables finance facilities through our relationships with 270+ banks, funds and alternative finance houses.

TFG’s award winning educational resources serve an audience of 160k+ monthly readers (6.2m+ impressions) in print & digital formats across 187 countries, covering insights, guides, research, magazines, podcasts, tradecasts (webinars) and video.

ASSOCIATION PARTNER

HR Maritime, founded in 2008 by Richard Watts, is a Geneva based company providing services to the International Trading, Shipping and Trade Finance Industries. With a client base both within Switzerland and around the globe we offer guidance and implement tailored solutions to the range of problems besetting a company involved in the Trading, Shipping or Financing of commodities. We work with Commodity Traders, Importers and Exporters, Ship Owners and Managers, P&I Clubs, Insurance Underwriters, Trade Financiers, Lawyers and a number of associated service providers. With our broad knowledge and experience across many areas of business, geographical regions and various commodities, we are able to approach nearly any problem or situation with a practical, pragmatic and innovative solution. We are equally at home working on enhancing efficiency within the largest trading companies as with small exporters or importers looking to break into the international markets. Our services focus on Consultancy, Outsourcing and bespoke Training.

ASSOCIATION PARTNER

Headquartered in Switzerland, Commodity Trading Club is the world's largest community of professionals in commodity trading, shipping, and finance, spanning the entire globe. We provide a broad spectrum of benefits, including exclusive business networking events and a cutting-edge commodity trading platform, fostering members' career and business growth.

SPONSOR

CommodityAI is a software platform built to automate and streamline operational processes in the physical commodities trading industry. It simplifies key tasks such as contract management, shipment tracking, and document handling through AI and automation, reducing complexity and manual effort in trade execution—enabling trading and logistics teams to work more efficiently and make faster, data-driven decisions that drive profitability. Founded by former traders with deep industry experience, CommodityAI delivers practical, tailored solutions to address the unique challenges of the commodities industry.

ASSOCIATION PARTNER

The Volta Foundation is a non-profit dedicated to advancing the battery industry. An association of 50,000 battery professionals, the Foundation produces monthly events (Battery Forums), publications (Battery Bits), industry reports (Battery Report), and open communication channels (Battery Street) to promote a vibrant battery ecosystem globally.

ASSOCIATION PARTNER

ZETA (Zero Emissions Traders Alliance), based in UAE, offers a meeting place and a public platform for companies and organisations with an interest in creating wholesale traded markets in climate neutral products. The vision is an emerging MENA ‘net zero emissions’ energy market including exports to neighbouring countries and globally.

LEAD ENERGY & COMMODITY MANAGEMENT SOLUTIONS PARTNER

ION Commodities is the leading provider of energy and commodity management solutions to organizations of all sizes. ION offers a comprehensive portfolio of innovative solutions that empower businesses operating in energy, commodity, and environmental certificate markets to adapt, grow, and unlock their full potential.

Digital commodity solutions by commodities experts.

ClearDox® allows commodity-intensive businesses to secure a competitive advantage by digitizing and automating critical document-intensive processes. ClearDox provides the only intelligent automation platform created for commodity companies by commodity experts. By unlocking data across their business interactions embedded in hundreds of types of documents, our clients improve operational efficiencies and resiliency, while making smarter decisions.

ClearDox is unique in the space by offering turnkey solutions across agriculture, metals, renewables, oil, and gas, covering vital processes including trade confirmations and inventory/transportation management, along with invoice and letter of credit processing. At the core is a patented multi-faceted AI approach that intelligently extracts the appropriate data for processing and automates the reconciliation process.